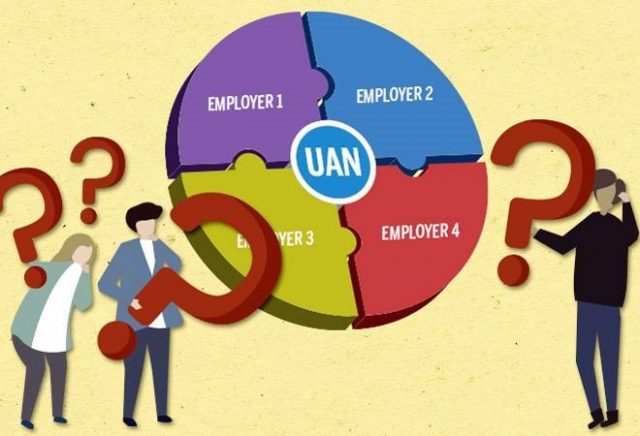

The EPFO integrated the UAN back in 2014. If you don’t know what is UAN number – it is a 12-digit unique number assigned to every holder of an Employees’ Provident Fund (EPF) account.

Your UAN number will remain same no matter how many times you switch your job. The EPFO will assign you a new member ID that will be liked to your UAN.

Since November 2017, the EPFO has enabled account holders to receive their UAN online. However, you have to know how to check, generate and activate your UAN to reap its benefits.

How to Get your UAN Online?

You have to visit the official Unified Portal webpage of the EPF to know what is UAN number.

Follow the steps mentioned below to after visiting the website:

- Click the “UAN Member e-Sewa” on the right.

- Click the “Know Your UAN Status” link under the “Important Links” section on the bottom right on the new page.

- Enter your Member ID, Aadhaar, or PAN. (You may need an Aadhaar-linked mobile number).

- Enter your name, date of birth, mobile number, email ID.

- Click on “Get Authorisation Pin”.

- Enter the OTP sent to your registered mobile number.

- Click “Validate OTP and Get UAN”.

Your UAN number will be sent to your mobile no.

How to Get your UAN Offline?

You can also receive your UAN through your employer upon request. Many a time, employers also provide the UAN on the salary slip.

How to Activate your UAN Online?

Now that you know how to get UAN number, you will have to activate the same. To do so, visit the same website.

Follow the steps mentioned below after doing so:

- Click the “UAN Member e-Sewa” on the right.

- Click on “Activate UAN” link under the “Important Links” section.

- Enter your UAN, Member ID, Aadhaar, or PAN as well as

name , date of birth, mobile number, email ID. (You may need an Aadhaar-linked mobile number). - Click on “Get Authorisation Pin”.

- Enter the OTP sent to your registered mobile number.

- Press the relevant button for validating OTP and generating your UAN.

Your UAN activation will be completed and the login password sent to your registered number.

How to Activate UAN offline?

If you want to know how to activate UAN number offline, you need to send following SMS to 7738299899:

EPFOHO ACT, “your 12-digit UAN”, “your 22-digit EPFO member ID”

Make sure not to put any space before and after the comma (,). Do note that standard operator charges will apply with this SMS.

Linking Aadhaar with UAN

Now that you know what is UAN number, you may need to link your Aadhaar with it for accessing some services. To do so, you have to head over to dedicated EPF webpage.

Follow these steps after doing so:

- Enter your UAN.

- Enter your mobile number.

- Click “Generate OTP”.

- Enter the OTP.

- Select your gender.

- Enter your Aadhaar number.

- Select either “Using Mobile/Email based OTP” or “Using Biometric” under for verifying your Aadhaar.

- Click “Submit”.

It is not mandatory to link your Aadhaar with your UAN. But doing so will make it more convenient to manage your EPF account. The government has made it compulsory to link your Aadhaar with various other services. For example, you can only pay income tax after linking your Aadhaar with PAN.

The Aadhaar has also become a crucial KYC document for financial products & services. Bajaj Finserv is an NBFC that requires customers to provide Aadhaar to avail financial advances such as their Personal Loans.

Bajaj Finserv brings you pre-approved offers on their personal loans, home loans, business loans, and an array of other financial products and services. Pre-approved offers lower the time taken for availing financing. You can check your pre-approved offer by providing a few of your essential details. Understand what is UAN number, activate it and link it with your Aadhaar. For instance, you can electronically transfer your PF balance to a bank account of your choice with the UAN. Benefit from the integrated system for fast transactions as well as easy management of your PF account.